INVESTMENT UPDATE JANUARY

| INDEX | LEVEL 30TH NOV | LEVEL 31ST DEC | CHANGE |

| S&P 500 | 4567 | 4769 | +4.4% |

| FTSE 100 | 7520 | 7733 | +2.83% |

| Euro Stoxx 600 | 461 | 478 | +3.69% |

| Nikkei 225 | 33487 | 33288 | -0.59% |

| Shanghai | 3029 | 2962 | -2.2% |

| US 10 Yr Treasury Yield | 4.31% | 3.86% | -0.45 |

| UK 10 Yr Gilt Yield | 4.17% | 3.54% | -0.63 |

| Bund 10 Yr | 2.4% | 2.02% | -0.38 |

Overview

The expression ‘Santa Rally’ is often used when referring to when financial markets experience a positive run before Christmas and as we approached the end of 2023 the use of it was certainly appropriate. The figures in the table above belie the extent of the rally, as when one combines the returns from November, we had double digit, or near double digit, returns in many markets. As an added bonus, returns which had, in the earlier part of the year, been generated from a narrow set of asset classes such as Technology related stocks in the US, continued to be generated from a wider range of asset classes. Indeed, the returns from Gilts through November and December were also near double digit and the broader equity indices were handsomely outperformed by mid and small capitalisation ones, albeit after a previously lacklustre year. All of these factors combined to give portfolios a much welcome lift at the end of the year. The catalyst for this was, as in November, speculation over the near-term direction of interest rates.

US

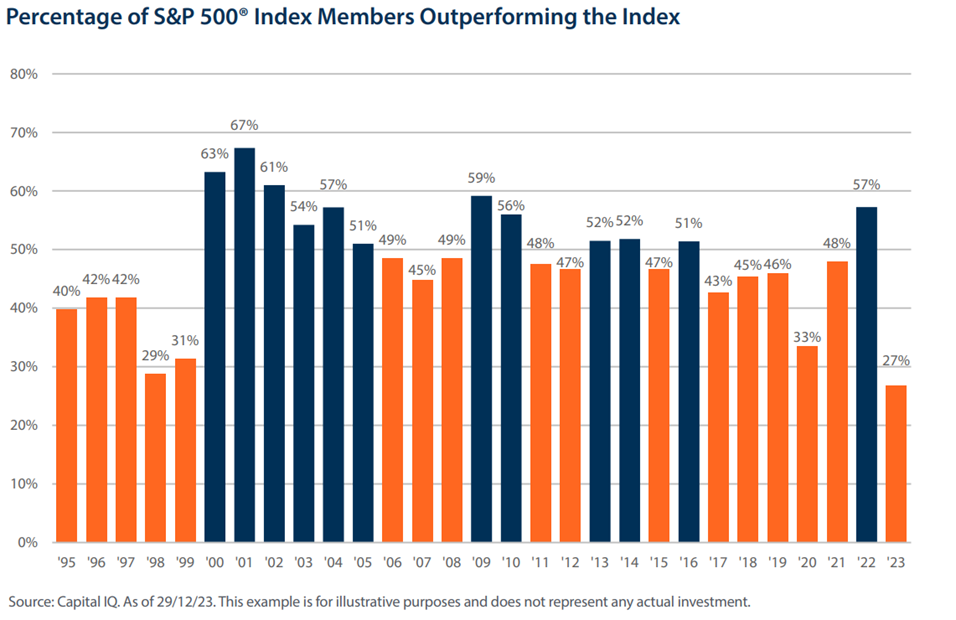

As mentioned in the introduction, the reasons behind December’s rally were a continuation of those which kicked it off in November; optimism that not only had the cycle of raising interest rates had ended, but indeed the point at which they will start to decline might be earlier than had been previously anticipated. US 10-year bond yields, which had briefly peaked at 5% in October, ended the year over 1% lower, which equated to some very decent returns from sovereign bonds (bond prices move inversely to yields). This in turn fuelled the rally in the wider equity market and the S&P finished up 26% in dollar terms over the year, although these returns were dented slightly for UK investors by a weakening dollar versus the pound. However, it needs to be remembered that a large proportion of these gains came from a relatively small number of stocks. The chart below shows how few companies managed to outperform the index itself thus demonstrating how narrow the market was.

The speculation over interest rates was driven by an indication in the US Federal Reserve’s (the Fed) meeting minutes, that they expected rates to be around 4.5% by the end of 2024, although the market clearly believed that the rate would be lower than this. Inflation rate numbers seemed to support the case for this, as the headline inflation number came in at 3.1% for November – a marginal decline on the previous month, although the core inflation year on year figure remained 4%.

However, the Fed’s preferred measure, the PCE (personal consumption index), later came in at a six-month annualised rate of 1.9%, lower than that of the Fed’s target of 2%. As we move forward into 2024, investors’ attention will move towards the US presidential election, which usually proves a boost for markets, but will be equally focused on whether inflation continues to move to meet the target and whether the higher rates needed to achieve this will result in a soft or hard (recession) landing, with a resulting negative impact on earnings.

Europe

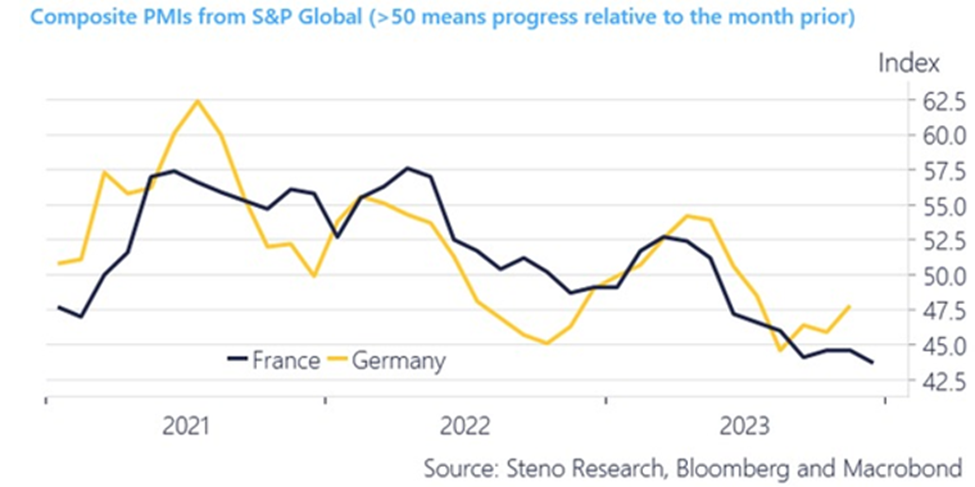

Despite the precarious state of many economies with Europe, the ECB attempted to dampen the same optimism that drove bond market returns elsewhere in western economies. As in the US, and elsewhere, they pointed to wage inflation as being a key determinant as to a reduction in rates. Regardless, markets seem to be indicating that they expect the ECB may cut interest rates ahead of the US Fed. The speculation around this was lent some support by measures such as the PMI (Purchasing Managers’ Index), where a measure of less than 50 indicates a softening of industrial activity:

This background of weak industrial activity, over 6 economies officially in varying degrees of recession coupled with weak EU growth forecasts of sub-1.25%, was clearly supportive of speculation of an early cut in rates.

UK

As in November, again as elsewhere, UK gilts continued to rally significantly, with the UK markets’ high duration (sensitivity to interest rates) profile leading to the strongest gains. Equities followed a similar pattern to the US, where mid and small capitalisation markets delivered the strongest gains. The FTSE 250 index returned over 8% versus the FTSE 100’s 2.83% - interest rate sensitivity and stronger pound being the drivers behind this. However, overall, the UK market returns were lacklustre compared to the majority of overseas benchmarks over the year. Again, the drivers for the returns we saw from both bonds and equities in December were inflation levels and the direction of interest rates. Whilst the UK continues to lag on the inflation front, it was welcome news to see the headline rate come in at 3.9% in November, with the core rate (which excludes energy, food and alcohol) down to 5.1% from 5.7% in October. Wage inflation is also a key measure for the Bank of England and, although we have seen a decline from the 8.5% peak in the summer, this still came in at 7.2% (driven it seems by deals in the public sector), and it remains to be seen if this will be a sufficient enough decline to influence the more hawkish members of the bank’s Monetary Policy Committee to ease policy.

Japan

Japan generated a small negative return in December, as speculation arose over the yield control policy* being abandoned, which drove the yen higher for the first time in a while. As a consequence, the Nikkei was up 4% in sterling terms and finished the year up 15%. There had been speculation that the delisting of Toshiba would have caused a redistribution of funds arising from that into the wider market, but thus far it would appear not. However, the economic and valuation backdrop still remains favourable.

Asia and Emerging Markets

Excluding China, Asia continues to benefit from the weaker dollar and Latin American markets continued their impressive run of late; up over 7% in dollar terms in December. Argentina however, had to cope with 54% devaluation of the peso as part of the new President Milei’s economic shock therapy. China continued to disappoint, as the country struggles to recover from the pandemic slump in economic activity, high debt burdens and real estate related issues. Chinese recovery is expected to lag for now, although the People’s Bank of China is unlikely to remain a passive bystander. China is heavily invested in modern technology and with a falling population and debt issues aplenty this is one area that could drive GDP up in the future.

Outlook

After such an impressive run across many markets in the last quarter of 2023, it is likely markets will pause to reflect at the start of 2024. Given the moves that have already taken place in fixed interest markets, it is likely markets will want to see a serious follow though in positive inflation data in order to support this, especially as yields are already lower than many end 2024 predictions. However, slowing economies could well provide this. The US equity market still has high valuations, but one can look beyond any distortions caused by the small number companies than contributed to the returns in 2023 and the US election may prove accommodative to markets. The move to reduce cash in early December looks to have been timely and the recent market moves may provide stimulus for further portfolio activity around cyclical and value stocks.

Rockhold Asset Management, with contribution from Alpha Beta Partners and Marlborough, January 2024

Your Capital is at risk. Past performance is not a reliable indicator of future results. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances. Your capital is at risk and the value of investments, as well as the income from them, can go down as well as up and you may not recover the amount of your original investment.

.png)