INVESTMENT UPDATE MARCH

| INDEX | LEVEL 29 FEB | LEVEL 31 MARCH | CHANGE* |

| S&P 500 | 5096 | 5254 | +3.1% |

| FTSE 100 | 7682 | 7952 | +4.2% |

| Euro Stoxx 600 | 494 | 512 | +3.6% |

| Nikkei 225 | 39166 | 40369 | +3.0% |

| Shanghai | 3015 | 3041 | +8.6% |

| US 10 Yr Treasury Yield | 4.25% | 4.2% | -0.05 |

| UK 10 Yr Gilt Yield | 4.12% | 3.94% | -0.18 |

| Bund 10 Yr | 2.40% | 2.29% | -0.11 |

*All return in local currency terms

Overview

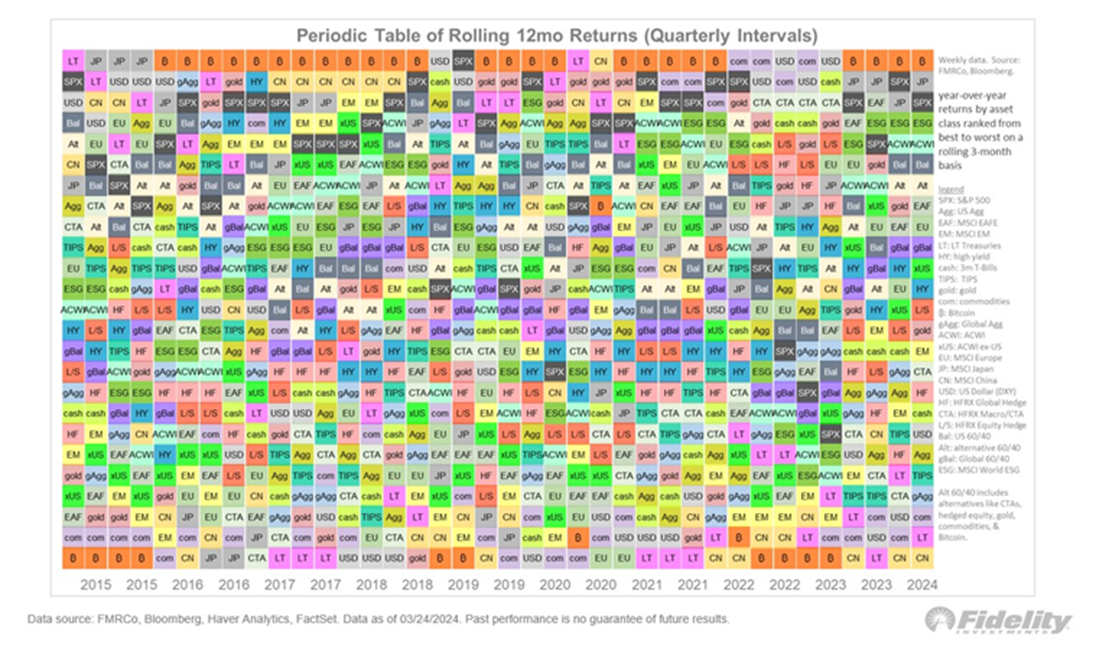

March saw a continuation of the broadening out of the source of returns across global equity markets, away from the so called Magnificent 7 in the US. As can be seen in the ‘league table’ below* Japan was the standout market over the quarter. Indeed, the wider MSCI World Index recorded its best start to the year since 2019. Whilst Nvidia still remains the focus of attention in the US, returns there too have now broadened out, with the S&P Mid-Cap index delivering a return of 5.6% in March. The FTSE 100 had its best relative month for a while, as overseas investors sought value opportunities, but the UK market lagged behind all bar China over the quarter.

*Bitcoin is not considered an investment, but it is interesting to see how it tends to occupy either the top or bottom spot, which is an indication of its inherent volatility.

After worries about stickier inflation in the US in February and March, bond markets settled down somewhat, with ten-year government bond yields almost unchanged in the US, whilst declining slightly in the UK and Europe where perhaps optimism over early rate cuts is greater.

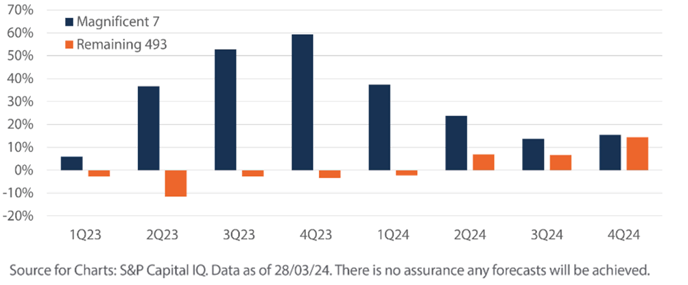

US

Markets took some comfort when US Federal Reserve (Fed) Chairman Jerome Powell said higher inflation in January and February appeared to have been driven by seasonable factors rather than inflation remaining stickier. The subsequent release of the closely watched core Personal Consumption Expenditures (PCE) indicator, which measures inflation excluding food and energy, eased to 2.8% year-on-year from 2.9%, giving further credibility to Powell’s comments. Consequently, the upwards trajectory for US bond yields was all but halted, although it is still expected that the number of interest rate cuts in 2024 will be limited to 3 and not commencing until June or July at the earliest. For now, the equity market rally remains intact with subdued volatility and witnessing a healthy broadening to more cyclical sectors beyond the important realms of artificial intelligence centric giant technology stocks. Using traditional metrics, US larger companies, particularly technology firms, are undeniably expensive. Corporate earnings have so far proven to be resilient, particularly for the 7 largest companies in the S&P 500, although it seems likely that their earnings growth will return to the level of the wider market later this year. The table below shows the earnings growth of the Magnificent 7 vs the rest of S&P 500 on an historic and forecast basis:

Europe

We witnessed the first interest rate cut by a European central bank as the Swiss National Bank cut its rate by 0.25%. The European Central Bank (ECB) meanwhile gave strong signals it is ready to start cutting interest rates in June. On March 20, ECB President Christine Lagarde said that by June, assuming the data supports inflation coming down, the ECB will “be able to move into the dialling back phase of our policy cycle and make policy less restrictive.” Consequently, there is increasing belief that the ECB will be the first major central bank to cut rates. Despite slow or negative economic growth across the continent, the prospect of lower rates meant we have seen new all-time highs on the Eurostoxx 600 index, with European banks performing exceptionally well as they reported higher earnings growth on the back of higher interest rates.

UK

As mentioned previously, the UK had a standout month as we saw inflation indicators come in at lower levels than previously expected, which led to increased optimism over the future direction of interest rates. This expectation was fuelled further when the Bank of England’s Monetary Policy Committee members voted 8-1 to keep rates unchanged, which was notable in being the first time that no member voted for an increase. Governor Andrew Bailey later stated in an interview that whilst he didn’t see rate cuts coming immediately, he did add that “we do need to see further progress, but I do want to give this message very strongly, we have had very encouraging and good news, so I think you know we can say – we are on the way.” This in turn helped to support the 10-year gilt, following a difficult start to the year after November and December’s exuberant rises.

Japan

After many months of expectation, Japan’s central bank finally raised interest rates for the first time in 17 years, as it became more confident that deflationary pressures had eased sufficiently to warrant such an action. This meant that rates became positive rather than negative. As a result, we saw the stock market achieve a new all-time time, some 34 years after the previous high was set. Despite the move to positive interest rates, the Japanese yen continued to weaken against the dollar, as the interest rate on dollar deposits still far exceeds that of those in Japanese yen. However, there is growing momentum behind the market following a period of corporate governance reform, which has given more confidence to both domestic and overseas investors. There is also hope that some of the enormous savings built up in Japan during decades of deflation will now find their way into the equity market, as the return of inflation discourages savers from keeping money in cash.

Asia and Emerging Markets

Asia and Emerging Markets continued to lag those in developed markets, although South Korea and Taiwan did have exceptional months, given their exposure to the information technology sector. China’s economic slowdown continues to hang over the Asian region. However, Chinese demand for copper has spiked dramatically higher, which is usually an indicator for increased manufacturing demand. Deflation in China is a real phenomenon and will no doubt open the gates, supported by a weaker Chinese Yuan, to a flood of cheap exports impacting western markets. This might have a positive impact on the inflation front in the West, although politically this faces headwinds, as politicians are already publicly discouraging China from ‘dumping’ cheap exports.

Outlook

The promise of lower interest rates, coupled with a Presidential election are reasons enough for US markets to feel more optimistic. Supplementary to the positive narrative, we can add solid economic growth, a robust labour market which drip feeds money into credit card spending via optimistic consumer confidence. Additionally, both the US Fed and Treasury seem to be ensuring that there is sufficient liquidity in the financial system to support this. We still need to be aware of the geopolitical and, this year, political backdrop may increase volatility later in the year and that the US market is not cheap by many measures. However, we address these risks by ensuring that portfolios are as globally diversified as possible. The recent broadening out of returns beyond the Magnificent 7 in the US, to the wider market there, as well to overseas markets seems to further validate this approach.

Rockhold Asset Management, with contribution from Alpha Beta Partners and LGT, April 2024

Past performance is not a reliable indicator of future results. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances. Your capital is at risk and the value of investments, as well as the income from them, can go down as well as up and you may not recover the amount of your original investment.

.png)